This February is Payroll Giving Month and we are raising awareness of this transformative giving process.

Payroll Giving is a way for an employee to give regularly to a charity or charities of their choice from their salary. It can also be known as Workplace Giving or Give As You Earn (GAYE).

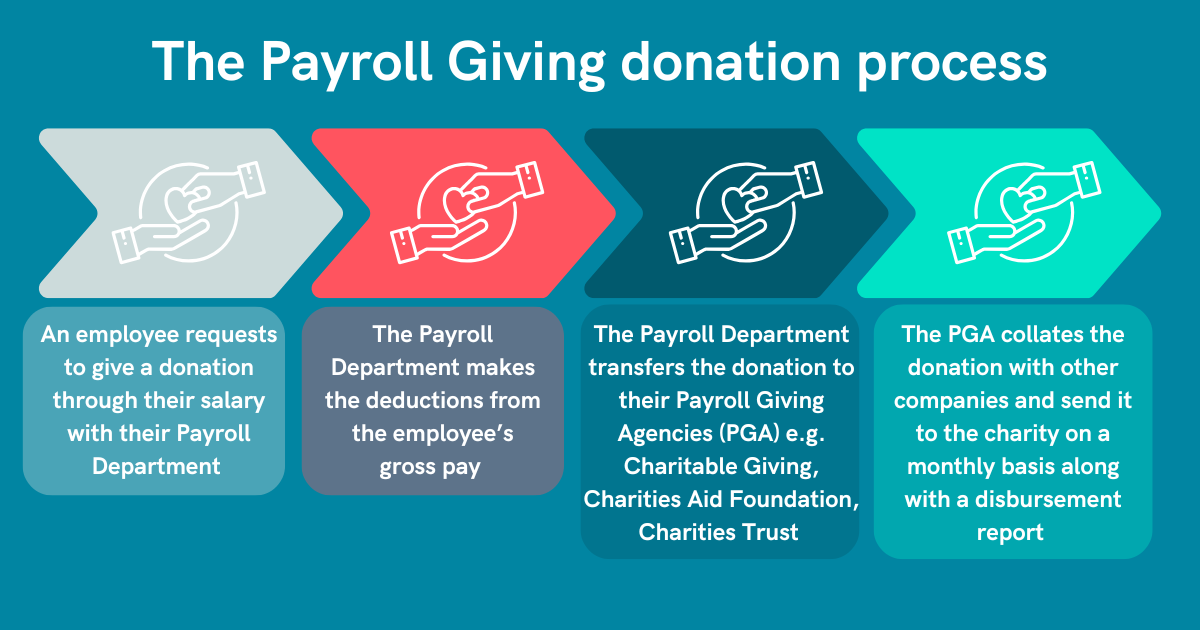

It is one of the simplest ways to give. The donation comes straight from the employee’s gross pay which they receive immediate tax relief. This means you can support research, information and support for the sarcoma community without paying taxes on the sum you’d like to donate, which you would otherwise incur when getting paid.

An employee will need to sign up to give through their pay. Once this has been completed, the requested donation is deducted from their gross pay before income has been applied. Their payroll department pass this onto a Payroll Giving Agent (PGA) who arrange for it’s transfer to the selected charity.

Get in touch with our team using the form at the bottom of this page to find out more about Payroll Giving.

Donor benefits

- Feel good about giving to a charity close to your heart

- Support as many charities as you like

- Deductions only taken whilst employed

- Can amend or cancel at any time, full control over your donation

Employer benefits

- Offers employees the ability to give

- Boosts the impact of a charity partnership

- Enhance public image and CSR activity